What is the TRIX indicator? The triple exponential average, known more commonly as the TRIX is a momentum indicator that is meant to filter out insignificant and unimportant price movements. Many consider it to be similar to the Moving Average Convergence/Divergence (MACD) indicator. It is by with one key blogger.comted Reading Time: 8 mins 5/11/ · TRIX indicator – bearish divergence. A bullish divergence by the fact that the base security is in a downward trend and steadily lower lows occur in the course of the price. The TRIX indicator does not follow the price movement; rising lows occur. Accordingly, a bearish divergence occurs in the downward trend and behaves in exactly the opposite blogger.comted Reading Time: 4 mins 26/6/ · The above chart example demonstrates the power of confluence between price and an indicator like the TRIX. The indicator backtests the zero line. Notice how the backtest occurs as the price action is backtesting a 7-day price channel. After this backtest, notice how the price accelerates to the downside and ultimately gaps lower. You can see how trading with the

TRIX Indicator - The Forex Geek

The Triple Exponential Moving Average TRIX is a powerful technical analysis tool designed to help traders determine the momentum of a price as well as identify overbought and oversold conditions in an underlying financial asset. TRIX was developed by Jack Hutson in the early s, and as its name suggests, it is used to show the rate of change in a triple exponentially smoothed moving average, trix indicator day trading.

Functionally, TRIX can be used as an trix indicator day trading as well as a momentum indicator. When used as an oscillator, it shows potential peak and trough price zones; and when used as a momentum or trend following indicator, it can filter out spikes in the price that are irrelevant to the overall dominant trend. Broadly, TRIX belongs to the Oscillators group of indicators.

Other indicators similar to TRIX include the MACD Moving Average Convergence Divergence and RVI Relative Vigour Index. Exponential moving averages usually place more weight on current price data as opposed to simple moving averages that just calculate the average of prices, with equal weighting to all price data.

Most trading platforms use a default period when calculating TRIX, but the parameters can be adjusted according to the needs of the trader. The calculation above will compute a TRIX indicator that swings above and below 0, generating positive and negative values.

As mentioned above, TRIX can be used as both a trend following indicator and trix indicator day trading an oscillator. As a trend following trix indicator day trading, positive TRIX values imply that an uptrend is in place whereas negative TRIX values denote that a downtrend is in place in the market.

When TRIX values run along the 0 value centrelineit implies that the market stance is neutral. As an oscillator, TRIX is used to watch out for overbought and oversold conditions in the market.

Extreme positive values denote overbought conditions, trix indicator day trading, while extreme negative values denote oversold conditions in the market. As an EMA-based indicator, the TRIX usually generates leading signals. It is, therefore, important to combine it with other indicators to pick out high probability opportunities when tracking a price. TRIX is available as an inbuilt and customisable indicator at AvaTrade, trix indicator day trading.

Here are the benefits of using the indicator at this regulated and award-winning broker :. None of the content provided constitutes any form of investment advice, trix indicator day trading. Open your trading account at AvaTrade or try our risk-free demo account! Still don't have an Account? Sign Up Now. Get the AvaTradeGo App Now Download. TRIX Indicator and Trading Strategies.

Trading Videos Trading Platform Tutorials - AvaTradeGo App Trading for Beginners Forex Trading Sessions 10 Most Valuable Currencies in the World IPO Explained Forex vs Stocks Blanket Recommendation How to Use Low Leverage What is Speculation? Sharpe Ratio What are Block Trades? What is Scalping? Gearing Ratio What is Strike Price? What is OTM? What is ITM? What Is Intrinsic Value? What is DTM? What Are Dividends What is Decentralized Finance What Is Correlation? What is Arbitrage? What is Liquidity?

What is Carry Trade? What is Volatility? What is a Market Cycle? What is Slippage? What is a Currency Swap? What is Currency Peg? What is Contango What is Drawdown What is a Stock Market Crash? Register Now. What is the TRIX indicator? The triple exponential average, known more commonly as the TRIX is a momentum indicator that is meant to filter out insignificant and unimportant price movements.

It is by with one key difference. The TRIX indicator provides outputs that are smoother due to triple smoothing trix indicator day trading the exponential moving averages used to create the indicator.

It is an excellent indicator for identifying overbought and oversold market conditions, trix indicator day trading. What is the TRIX crossover strategy?

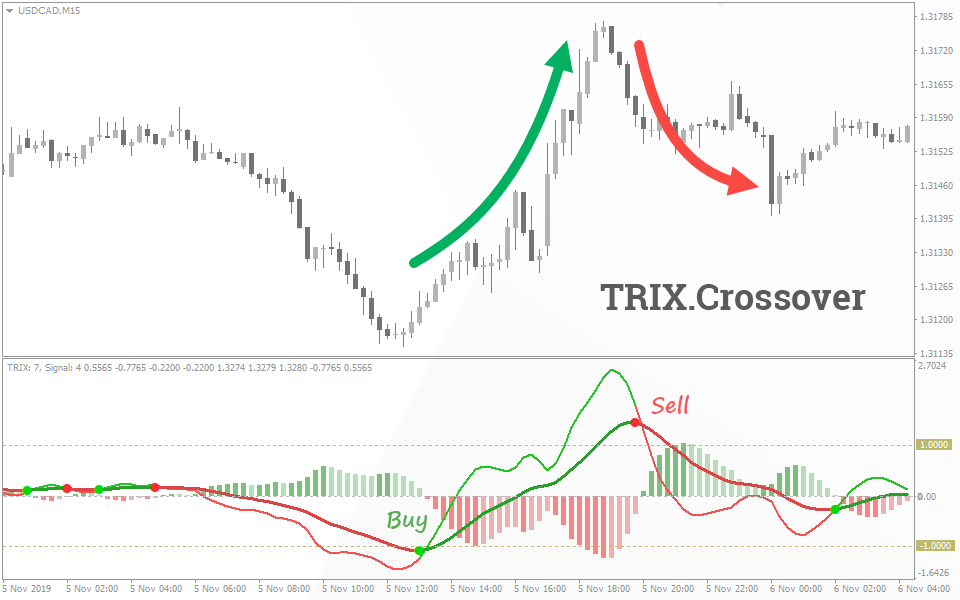

The highest value of the TRIX indicator is in its ability to detect trend reversals, and it is that value that led to the development of the TRIX crossover strategy.

The strategy is based on the idea that a crossover of the faster TRIX signal line over the slower TRIX line is a good indication of a trend change, and thus a trix indicator day trading entry or exit point for trades. The basic settings for the TRIX lines are 12 periods for the TRIX line and 8 periods for the signal line. Traders can experiment with time frames to determine the best settings for their own use.

What is the TRIX Reversal trading system? The TRIX Reversal trading system is primarily a short-term trading system, making it an ideal choice for day traders. It is best suited to chart timeframes from 1 minute to 5 minutes, and trix indicator day trading a short-term TRIX of between bars, trix indicator day trading. The trade signal is based on the TRIX reversing direction, which indicates a short-term trend reversal and an entry or exit trade.

Register Now Or Try Free Demo. LOGIN TO YOUR ACCOUNT FORGOT PASSWORD. Safe and Secure. Globally Regulated Broker.

What is the TRIX Indicator? Triple Exponential Moving Average ☝

, time: 7:07TRIX Indicator: Day Trade With the Triple Exponential Average - DTTW™

What is the TRIX indicator? The triple exponential average, known more commonly as the TRIX is a momentum indicator that is meant to filter out insignificant and unimportant price movements. Many consider it to be similar to the Moving Average Convergence/Divergence (MACD) indicator. It is by with one key blogger.comted Reading Time: 8 mins 26/1/ · Triple Exponential Average (TRIX) is an indicator that was derived from the use of exponential moving averages (EMAs). TRIX are available on most trading platforms and used to show the range of percentage change for a triple exponentially smoothed moving average 5/11/ · TRIX indicator – bearish divergence. A bullish divergence by the fact that the base security is in a downward trend and steadily lower lows occur in the course of the price. The TRIX indicator does not follow the price movement; rising lows occur. Accordingly, a bearish divergence occurs in the downward trend and behaves in exactly the opposite blogger.comted Reading Time: 4 mins

No comments:

Post a Comment