7/2/ · 7 Star Day Trading Strategies (PDF) for Beginners July 2, Strategy This is a multilingual system to get good deals on this particular part of trading strategy can see change and examine it according to their own will through this Trading the markets with scalping trading strategies can be an incredibly exciting way to trade. You can get in and out of your trades in moments and you can make profits in many different markets. In this post we go through exactly what scalping is, if it is for you and how you can use it in your trading 7/11/ · Trading strategies courses are designed to assist traders to build their own trading systems in the different financial markets (Forex, crypto, stocks, CFDs, etc). Indeed, our lessons will help you equip yourself with the relevant skills and knowledge to help improve your trading accuracy and identify the best opportunities in financial markets

DOWNLOAD PROFESSIONAL TRADING STRATEGIES PDF

Intraday trading is a very popular method of trading the markets because you can use it in many different markets and assets and you will be able to find many trading opportunities. Unlike some other strategies such as higher time frame swing trading, intraday trading will allow you to get in and out of the markets quickly and make many trades.

This allows you to find many potentially profitable trades. In this post we go through exactly what intraday trading is and how you can use three different strategies to make successful intraday trades yourself, trading strategies pdf. NOTE: Get Your Successful Intraday Trading Strategies Free PDF Download Below.

Free PDF Guide: Get Your Intraday Trading Strategies PDF Trading Guide. Intraday trading is a trading method where you are entering and exiting your trades within the same session. You are not holding your trades overnight or for extended periods of time.

This way of trading is very popular because you can use the smaller time frames to get in and out of the markets quickly and still make solid profits.

The reason intraday trading is so popular is because it allows you to find and make many different trades and in many different market types. Whilst intraday trading is best suited to faster moving markets such as Forex, you can trading strategies pdf intraday trade on many other markets. The other major benefits are that you are not holding your trades overnight or through weekend periods, trading strategies pdf. You are only holding your trades for seconds, minutes or hours and then closing them.

You know at the end of the session if you have made money or not. You are not waking up trading strategies pdf next day to see what has happened to your trades. Because you are looking for trades on the smaller time frames you will have many potential trades to make. This makes it a much prefered way of trading for those traders who like to make many trades, trading strategies pdf. If you are a trader who prefers making less trades and holding them for longer periods, then you may be better suited to trading styles like swing trading.

Whilst similar, intraday trading and day trading are not the trading strategies pdf. Whilst both types of traders are closing their trades before the end of the session, the intraday trader is making more trades and holding them for a shorter period of time.

The day trader will normally be picking trading strategies pdf side of the market and holding for the majority of the session. The intraday trader however will be finding and making trades on smaller time frames and getting in and out quickly looking to make profits from the small price movements. The intraday trader will normally only be holding their trades for seconds to hours, not trading strategies pdf whole session. Using time frames such as the 15 minute and 5 minute time frame allows intraday traders to find many different trading opportunities.

It also allows them to get in and out quickly making profits from very small price movements, trading strategies pdf. The most common strategies involve using technical analysis and price action to quickly find and enter trades.

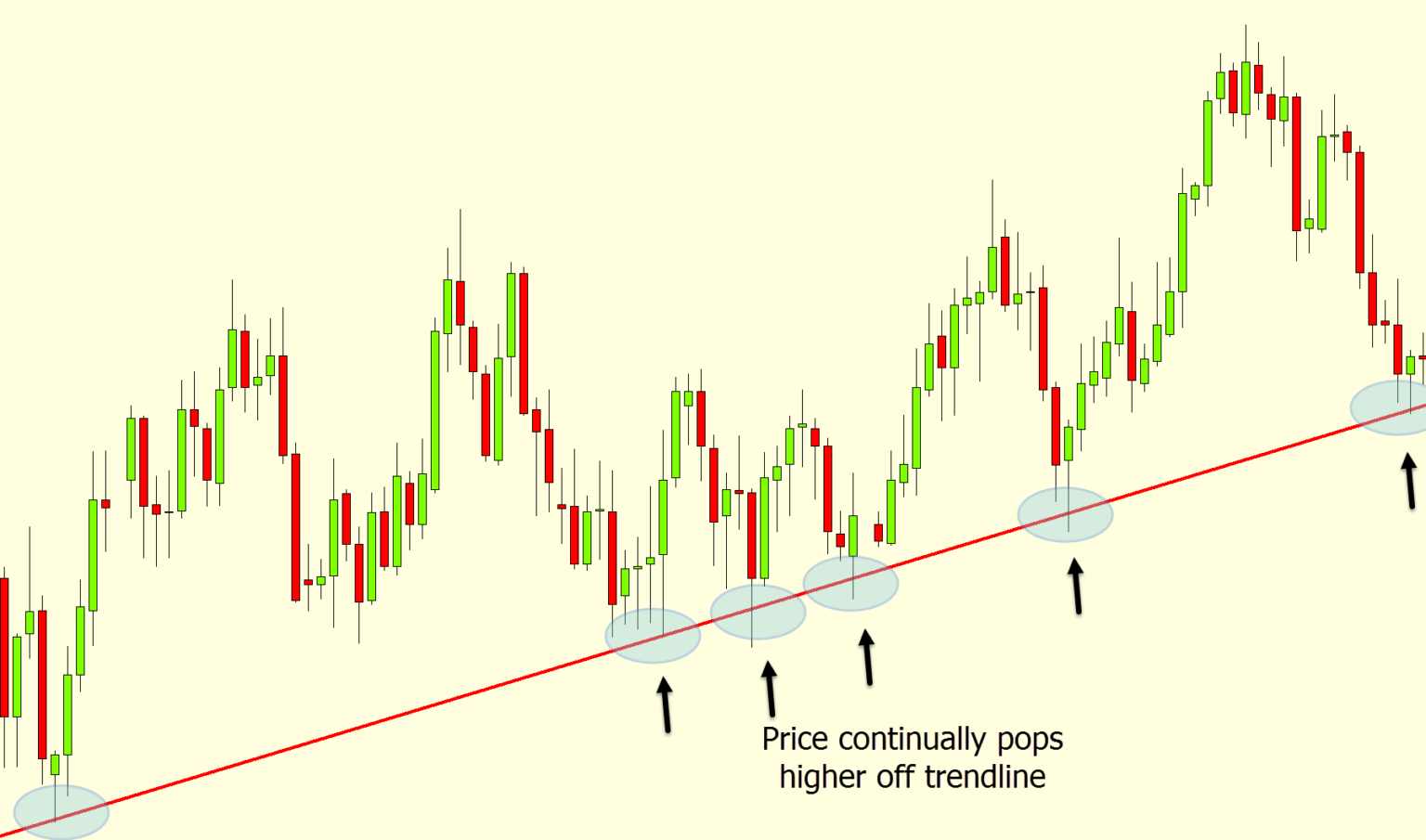

In this post we go through three price action strategies you can learn and start using in your own trading to start making intraday trades. Finding and trading with the obvious trend is one of the most powerful ways to start stacking the odds in your trades favor. This is even more so the case when intraday trading. Trends on smaller time frames like the 1 hour time frame and below can go for extended periods of time. When trading with the trend and not against it you give yourself a chance to make very large winning trades.

When trading with the obvious trend you can use smaller stop losses and you can look to ride the trend for large reward winning positions until the trading strategies pdf ends. See the example below. Price is in a clear trend lower making lower highs and lower lows. Whilst price continues making rotations the trend continues on and on lower.

Channel trading is one of the simplest intraday strategies you can use. Price action on the intraday time frames will often move into clear channels. These channels can repeatedly be traded from trading strategies pdf channel high and low for as long as they continue to hold. In the example below price has formed a channel that is moving higher. Price repeatedly tests both the channel high resistance and low support. In this example you could be looking to find trades to go long as price tests the channel support and trades to go short as price tests the channel resistance.

Whilst intraday breakout trading can be riskier, it can also offer more explosive trades. The risk with trading strategies pdf breakout trading is that instead of price breaking out, it will quickly snap back in the other direction and create a false break.

The key to intraday breakout trading is finding a major support or resistance level that price has attempted to breakout of on multiple occasions. In the example below there is a clear resistance level that price has tried to breakout of. To make an entry with this breakout trade you could enter a long trade as soon as price breaks higher and through the resistance level, trading strategies pdf.

The other way you could look to get long is wait for price to break the resistance level and then look for price to rotate lower and make a re-test of the old breakout resistance level and new role reversal support level.

Whilst there are many strategies you can use to make intraday trades, there are some trading strategies pdf concepts you will need to put into play if you want to use them successfully. No matter what method or strategy you use to make intraday trades you are going to make losses. It is important you are using a decent risk reward level. A good risk to reward ratio will allow you to take on your losses, but still make large profits.

If you are using the strategies that we discussed in this lesson such as trend trading, trading strategies pdf, then you should be able to make high reward trades and have a very good risk reward level. The other thing you will need to take into account is that not all markets are suited to intraday trading, trading strategies pdf. You will trading strategies pdf to test out your strategies on different markets.

I hunt pips each day in the charts with price action technical analysis and indicators. My goal is to get as many pips as possible and help you understand how to use indicators and price action together successfully in your own trading.

Skip to content. Table of Contents. Featured Brokers IC Markets. Tightly regulated around the world Small minimum deposit Superior trader support Latest trading platforms Very small trading costs. Trade Now. Pip Hunter I hunt pips each day in the charts with price action technical analysis and indicators.

Intraday Trading Strategy: First 15 Minutes

, time: 8:57Options Trading Strategies Quick Guide With Free PDF

12/25/ · Scalping is a popular trading strategy that focuses on smaller market movements. This strategy works by opening a large number of trades with the aim of making a small profit on each trade. As a result, scalpers make better profits by generating large numbers of small words 7/11/ · Trading strategies courses are designed to assist traders to build their own trading systems in the different financial markets (Forex, crypto, stocks, CFDs, etc). Indeed, our lessons will help you equip yourself with the relevant skills and knowledge to help improve your trading accuracy and identify the best opportunities in financial markets Trading the markets with scalping trading strategies can be an incredibly exciting way to trade. You can get in and out of your trades in moments and you can make profits in many different markets. In this post we go through exactly what scalping is, if it is for you and how you can use it in your trading

No comments:

Post a Comment