⚠️ คำเตือนเรื่องความเสี่ยง: การเทรด Forex ด้วยเลเวอเรจที่สูง สามารถทำให้ขาดทุนหรือสูญเสียเงินทั้งหมดในพอร์ตได้อย่างรวดเร็ว (หรือมีกำไรอย่าง To predict the sideways market, traders need to identify volatility decrease using indicators (ATR, volatility, VIX, etc.) and defined price range using support and resistance. Usually, price oscillation in the range and a clear declining trend in volatility are early signs of the sideways formation. However, it is tough to create any Estimated Reading Time: 7 mins แนวโน้ม Sideway ควรเทรดหรือเลี่ยงก่อนดี? การเทรด Forex มักจะมีช่วงเวลาที่เราสมารถทำกำไรได้อย่างชัดเจนอยู่ โดยช่วงเวลานั้นมักจะเกิดเมื่อตลาดมี

Sideway คือ อะไร พื้นฐานการเทรด- Thaibrokerforex อธิบายอย่างละเอียด

Most systems in trading are trend-following systems. But the market can be in a tight range over a long period. A sideways market or a sideways drift occurs when the prices of investments remain in a tight price range for any period.

They do not form many distinct trends for a significant time. In such a market, neither the bulls nor sideway forex bears take charge of the market, sideway forex. Trading sideways represents the trading style when open positions are made within a reasonably stable price range without forming sideway forex bullish or bearish trends over some time.

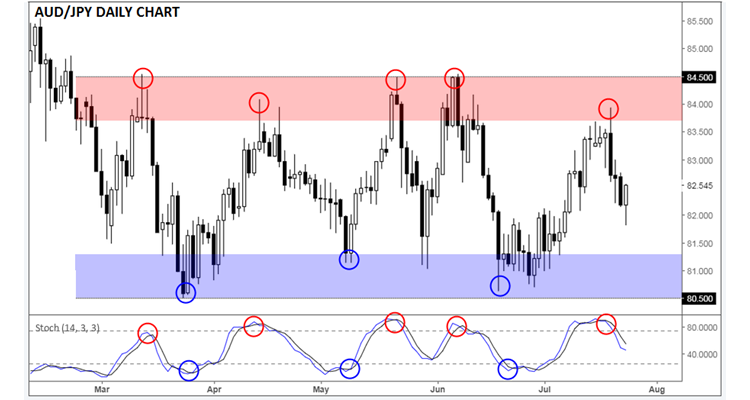

Usually, trading sideways presents trading in a tight price range. The best way to identify a sideways market is the identification of support and resistance levels. Support and resistance levels create a range where traders enter a position once the price drops to support level and sell when the price rises to resistance levels. Thus, trading sideways implies buying assets at the support level and sell on the resistance sideway forex. But, how we can sideway forex the future range market.

I know it is almost impossible but are there any signs that can help us? To predict the sideways market, traders need to identify volatility decrease using indicators ATR, volatility, VIX, etc. and sideway forex price range using support and resistance. Usually, price oscillation in the range and sideway forex clear declining trend in volatility are early signs sideway forex the sideways formation. However, it is tough to create any prediction in financial markets and the sideways market.

For example, AUDCHF the whole summer of is in the tight range on the image below:. One of the primary things that a sideways market tells a trader is that the price trend will not see a sudden change. It will move horizontally or in the same direction as before. A sideways market is not the calm before the storm. Since the stocks are neither reversing sideway forex reaching a more significant price, this situation is also called consolidation. During this period, the traders are unsure how the market would react once this stable period is over.

Therefore, they build on their past gains with caution, waiting for the market to reverse its course. As time progresses without any change and the traders keep holding on, they gain sideway forex. Consolidation often happens when the market is about to go higher or lower than the previous highs and lows.

The only exception is if it is occurring during the transition of a business cycle. It then foretells the upcoming phase of the business cycle. However, a sideways market may also occur before the market is preparing to become bearish.

Similarly, a recession, sideway forex, which often marks the bottom of a business cycle, can make a sideways market signal that the bulls control. Economic indicators can guide you during this time.

They show the current phase of the business cycle. Algorithms based on machine learning and simple regression models usually can not easily predict the sideways market. However, sideway forex, low volatility, low impact trading news usually follow range markets. The market can be in a tight range for a few hours but several months as well.

A sideways market depends on two things, support and resistance. In a trading market, the buyers come back in when support is the price. But, au contraire, the buyers sell their investments with resistance as they are confident they will go any higher. Thus, one can easily predict whether they are dealing in a sideways market or not by assessing support and resistance levels, sideway forex.

A sideways market is more neutral in the sense that it operates within support and resistance. This situation is referred to as a range-bound market. There may be occasional highs or lows, but the price movement neither crosses the highest high nor dips below the lowest low. In case it happens, sideway forex, that is the end of the sideways market. It, sideway forex, then, makes way for either a bull market or a bear market, sideway forex.

The bulls take over when the prices exceed the resistance levels, sideway forex, and the bears take over when the prices fall below the support level. Since the price movement is horizontal in a sideways market, it offers fewer trading opportunities to the day traders. It is a slow market and better suited for the ones who are planning to buy and hold. No trading market stays stable forever; the sideways market will change as well.

Before it happens, days traders are advised to diversify their investments. Smart asset allocation is the key to leveraging a sideways market.

Here, time becomes secondary. As a result, day sideway forex need to rebalance their allocation in a sideways market. For example, sideway forex, in Januarythere was a beginning of a sideways trading pattern. On January 26,the Dow reached 26, After that, however, it ended up in correction territory and has been trading in a sideways range between 23,00 and 25, since then.

Another incident of a sideways market occurred when the contraction phase of the business cycle ended in The fear of further contraction pushed investors to boost their prices. They wanted to avoid the Congressional threats of a potential debt default and a debt ceiling crisis.

The commotion cost various traders a massive chunk of their investments when the bull market in gold ended, and the gold market traded sideways for most of The gold market often becomes bullish during crises.

Inthe gold prices entered a bear market because the economy sideway forex improving. The prices sideway forex on falling in In the middle of an sideway forex phase of the business cycle, the traders may switch from small-cap stocks to large-cap stocks.

Sideway forex, consolidation occurs, sideway forex, which can also signify a sideways trend. Privacy Policy. Home Choose a broker Best Forex Brokers Learn trading Affiliate Contact About us. Home » Education » Finance education » Trading Sideways — How to Predict Sideways Market?

Table of Contents. Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is Leverage Meaning? How to Calculate Pips in MT4? How to Fix When MT4 Stuck on Waiting for Update? Related posts: How to Predict Forex Movement?

What is Paper Trading in Stock Market? What is the Largest Forex Market in the World? Forex Market Geometry. Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world.

Diversify your savings with a gold IRA. VISIT GOLD IRA COMPANY. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates What is PAMM in Forex? Are PAMM Accounts Safe? Stock Exchange Trading Hours Which Forex Broker Accept Paypal? Main navigation: Home About us Forex brokers reviews Investment Education Privacy Policy Risk Disclaimer Contact us.

Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter, sideway forex. Spanish language.

ระบบเทรดสั้น Forex - แชร์เทคนิคเทรดจังหวะ Sideway ใน M5

, time: 8:38Sideways Market / Sideways Drift Definition

กลยุทธ์ เทรด Forex ในช่วงตลาดไซด์เวย์ Sideway. เทคนิคหรือกลยุทธ์ต่างๆในการเทรด หรือเก็งกำไรในตลาดค่าเงิน รวมทั้งหุ้น หรือ แนวโน้ม Sideway ควรเทรดหรือเลี่ยงก่อนดี? การเทรด Forex มักจะมีช่วงเวลาที่เราสมารถทำกำไรได้อย่างชัดเจนอยู่ โดยช่วงเวลานั้นมักจะเกิดเมื่อตลาดมี To predict the sideways market, traders need to identify volatility decrease using indicators (ATR, volatility, VIX, etc.) and defined price range using support and resistance. Usually, price oscillation in the range and a clear declining trend in volatility are early signs of the sideways formation. However, it is tough to create any Estimated Reading Time: 7 mins

No comments:

Post a Comment