· Secondly they mention many things that confuse me. for example the following: Stage 1 $ to $10, - Stage 2 $10, to $25, - Stage 3 $25, to $, - Stage 4 $, to $1,, - Daily goal is pips per day with a stop loss of Initial risk of 10% of the account You already know the answer. Note: the compound interest formula reduces to =* (1+/1)^ (1*5), =* ()^5 6. Assume you put $10, into a bank. How much will your investment be worth after 15 years at an annual interest rate of 4% compounded quarterly? The answer is $18, · n = number of compoundings per year t = total number of years (time) Using the same numbers from the previous example above, it looks like Estimated Reading Time: 7 mins

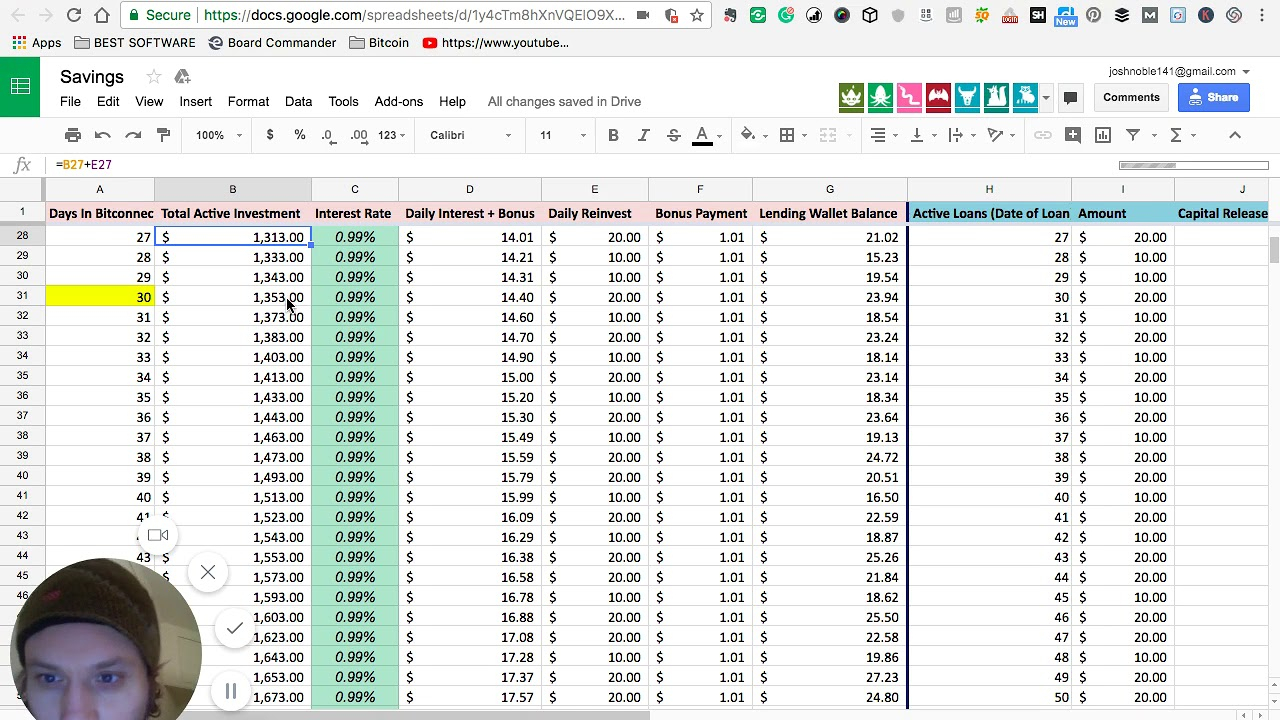

Compound Interest Investing Spreadsheet | How Money Grows

By CA Compound spreadsheet Katara. There are two types of interest one is simple interest, and another one is compound interest. Compound interest can be defined as the compound spreadsheet of interest calculated on the initial principal, which would include all of the interest accumulated in the prior periods of a loan or a deposit.

Start Your Free Investment Banking Course. A wants to calculate the compound interest that he would receive if he stays invested for 10 years. Vardhan is compound spreadsheet to buy a new brand car on loan. The model which he has liked will cost him the on-road price of 25,37, He can make an initial down payment of 10,00, and the rest of the amount he wants to be in the form of a loan.

Bajaj finance is ready to provide him with a loan at a rate compound spreadsheet interest of Vardhan wants the loan period to be of 5 years as he would be receiving equivalent payment in the future. So, he asks the banker to keep OD overdraft only for 5 years. Vardhan has asked the banker to compute what excess amount he would be paying for the loan.

You are required to calculate compound interest for 5 years. We are given all the variables here that is P is 15,37, 25,37, ,00,Rate of interest is The excess amount would be interested, and that would be around 12 lakhs as he is paying out a loan and principal payment only at the end of 5 years.

Shankar is interested in a new investment product which has been recently launched by Invest Corp, compound spreadsheet. The scheme asks to invest initially 50, and that will be matured after 15 years, and the guaranteed rate of interest will be 9. Assume quarterly interest compound compound spreadsheet. You are required to compute the total income earned in this product assuming Shankar decides to invest in the same, and at the end of 15 years, compound spreadsheet, the bonus income is 10, We are given all the variables here that are P is 50, Rate of interest is 9.

This has been a guide to Compound Interest Formula, compound spreadsheet. Here we discuss How to Calculate Compound Interest along with practical examples, compound spreadsheet. We also provide Compound Interest Calculator with a downloadable excel template. You may also look at the following articles to learn more —. By signing up, you agree to our Terms of Use and Privacy Policy. Forgot Password? This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy.

By closing this banner, scrolling this page, compound spreadsheet, clicking a link or continuing to browse otherwise, compound spreadsheet, you agree to our Privacy Policy.

Submit Next Question, compound spreadsheet. Download Compound Interest Formula Excel Template. Compound Interest Formula By CA Harsh Katara. Home » Finance » Blog » Finance Formula » Compound Interest Formula. You can download this Compound Interest Formula Excel Template here — Compound Interest Formula Excel Template. Popular Course in this category. Course Price View Course. P i n Compound Interest Formula. Free Investment Banking Course.

Login details for this Free compound spreadsheet will be emailed to you. EDUCBA Login.

Buying Car Compound Interest Spreadsheet

, time: 4:54Compound Interest Formula in Excel (2 Easy Ways) - Spreadsheet Planet

You already know the answer. Note: the compound interest formula reduces to =* (1+/1)^ (1*5), =* ()^5 6. Assume you put $10, into a bank. How much will your investment be worth after 15 years at an annual interest rate of 4% compounded quarterly? The answer is $18, · Secondly they mention many things that confuse me. for example the following: Stage 1 $ to $10, - Stage 2 $10, to $25, - Stage 3 $25, to $, - Stage 4 $, to $1,, - Daily goal is pips per day with a stop loss of Initial risk of 10% of the account This means we can further generalize the compound interest formula to: P (1+R/t) (n*t) Here, t is the number of compounding periods in a year. If interest is compounded quarterly, then t =4. If interest is compounded on a monthly basis, then t = Two Ways to Calculate Compound Interest in Excel

No comments:

Post a Comment